A Global View of Venture Capital in 2025

Endeavor Catalyst’s 2025 Annual Report offers a compelling and data-rich look at how innovation and venture capital are shifting around the world, and why “Elsewhere Markets” (regions outside the traditional U.S./Silicon Valley VC focus) are increasingly driving opportunity and momentum. At a time when global venture capital activity once again exceeds $90 billion per quarter, the report highlights not just how much capital is flowing, but where it’s going and why it matters.

Below are the key takeaways shaping the next chapter of global venture capital:

1. Accelerating Investment Momentum and Portfolio Growth

2025 marked one of the most active years for Endeavor Catalyst since the 2021–2022 boom. The fund deployed nearly $70 million across 50 new investments, with the second half of the year showing particularly strong momentum. This reflects a broader rebound in global venture activity, with Q4 2025 marking five consecutive quarters of growth in total capital invested worldwide.

This activity is significant not just in volume but in diversity, geographically and by industry, showing that founders across regions are building meaningful, durable businesses even as capital markets shift.

2. Elsewhere Markets Leading Innovation

One of the clearest themes in the report is that innovation is no longer concentrated in a handful of traditional VC hubs. Endeavor Catalyst’s portfolio spans 37 countries, with first-time investments in places like Puerto Rico and rapid expansion across regions such as Europe and the Middle East. Latin America continues to be a dominant region, but Europe’s tech hubs and the Middle East’s growing innovation ecosystems are emerging as serious players in venture capital.

The report also underscores that regional innovation is producing category-defining businesses, especially in sectors like AI, fintech, healthcare, and mobility. These are the areas where local talent and global capital are intersecting in powerful ways.

3. The Continued Rise of AI and Deep Tech

AI’s influence on global venture trends is unmistakable. In 2025, AI companies accounted for more than half of all global VC funding, with major megadeals pushing total invested capital beyond historic levels. Venture capitalists are not just funding generative AI applications but are investing across all layers of the AI stack — from infrastructure to models to end-user applications.

Endeavor Catalyst’s portfolio reflects this trend, backing a range of AI-native companies addressing everything from enterprise automation to consumer-facing tools. This aligns with the broader observation that the current technological shift is “once-in-a-generation,” with founders deeply engaged in redefining industries through AI.

4. Entrepreneurial Experience Matters

The report highlights that founders who have previously built companies are increasingly launching new ventures with even greater scale and impact. Nearly one-fifth of the 2025 investments were in subsequent ventures led by seasoned Endeavor Entrepreneurs, suggesting that deep experience, domain expertise, and iterative learning continue to shape the next wave of high-growth companies.

5. Emerging Paths to Liquidity

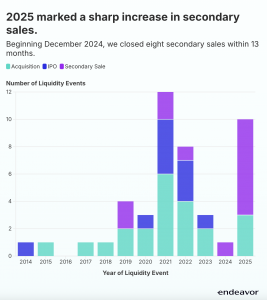

A standout finding from the 2025 report is a rise in alternative liquidity events. Traditional exit channels like IPOs remain constrained, but the global venture landscape is evolving: secondary sales and M&A are offering meaningful pathways for founders and investors to realize value. In 2025 alone, the Endeavor Catalyst portfolio saw 10 liquidity events, a substantial increase from just one in 2024, including acquisitions and secondary share transactions.

This trend reflects broader market realities: companies are staying private longer, and secondary markets are providing necessary liquidity options, especially important in emerging markets where traditional IPO windows can be less accessible.

Takeaways for Founders and Ecosystems

- The 2025 report reinforces several strategic truths for the global entrepreneurial community:

- Innovation is global. Breakthrough companies are being built everywhere — not just in Silicon Valley.

- AI is reshaping every sector. Capital and attention are increasingly focused on companies that leverage AI meaningfully.

- Experience compounds. Founders who have built before are among the most likely to unlock the next generation of scaled enterprises.

- Liquidity markets are diversifying. Secondary transactions and alternative exit pathways are emerging as key components of long-term venture success.

Collectively, these insights emphasize that global venture capital is more dynamic, more distributed, and more opportunity-rich than ever, and that supporting founders across geographies with capital, mentorship, and community remains critical to sustaining high-impact entrepreneurial ecosystems.