Venture capital is shifting, and the next big moves aren’t coming from Silicon Valley.

From stablecoins in Latin America to robotics in Eastern Europe, the future is being built Elsewhere.

As global momentum accelerates around high-growth entrepreneurship, new data and founder behavior are signaling a clear shift: venture capital is flowing into markets once overlooked, and it’s fueling a new generation of startups with global ambition. At Endeavor, we see this momentum building Elsewhere, and 2026 is shaping up to be a defining year.

A new article from our partners at Endeavor Catalyst highlights eight venture capital trends shaping this future, based on insights from over 650 founders in 35+ markets. We’ve distilled the key takeaways, spotlighted relevant Endeavor Miami companies, and added local context to share how these global currents are relevant to our community.

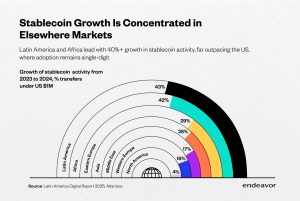

1. Stablecoins are gaining ground in economies with failing currencies

Crypto has entered a new chapter. Gone are the days of speculative trading dominating headlines. Today, the spotlight is on stablecoins, digital assets pegged to fiat currencies like the US dollar, as tools for real-world use cases, especially in volatile economies.

In countries like Argentina, where inflation reached 118% in 2024, stablecoins now account for over 60% of crypto trading. The market has grown to a $250B asset class powering everything from savings to cross-border payments. This trend is especially relevant to Miami-based Felix, an Endeavor company leveraging stablecoin infrastructure to facilitate cross-border remittances, offering faster and more inclusive access to financial services.

2. Drones and robotics are quietly reshaping the supply chain

Automation isn’t coming; it’s here. Globally, the use of robotics and drones in logistics is transforming delivery and warehousing, especially in regions where infrastructure gaps persist. In places like Nigeria and Romania, companies like Zipline and Dexory are showing how robots can leapfrog human limitations to unlock scale and efficiency.

This wave of innovation highlights an opportunity for founders to build smarter logistics models with fewer resource constraints. It’s also relevant to Miami, a gateway for international trade and logistics, where automation can provide resilience and speed across borders.

3. Liquidity pathways are evolving beyond IPOs

With IPO windows narrowing and M&A activity cooling, secondary transactions are stepping in to offer liquidity for founders, early employees, and investors. Global secondary transaction volume surpassed $60B in 2025, and the trend is expected to continue growing.

In Latin America, companies like Klar and Kavak have raised large late-stage rounds that include secondary elements, preparing for future exits while maintaining control. This is good news for Miami-based startups seeking strategic liquidity options before a public debut.

4. Cybersecurity is a foundational layer in an AI-first world

As AI tools grow more sophisticated, so do the risks. Founders around the world are embedding cybersecurity into their stacks from day one, not just to prevent fraud but to build trust with customers and partners.

Endeavor companies like Incognia (Brazil) and Picus Security (Türkiye) are leading with identity tech and real-time attack simulation. For Miami-based companies exploring AI, fintech, or e-commerce, cybersecurity is no longer a nice-to-have—it’s the infrastructure for scale.

5. Latin America is heading into a liquidity-ready era

With 39 unicorns and dozens of scale-ups preparing for exits, Latin America is positioning itself for a wave of liquidity events in 2026. While IPOs remain rare, strategic acquisitions and secondary rounds are offering new routes to scale and monetization.

This is encouraging for the Endeavor Miami network, as many of our founders are scaling across LatAm and participating in cross-border dealmaking. The more mature the region becomes, the stronger the capital and talent flows for our ecosystem.

6. Saudi Arabia is transforming the Middle East

Vision 2030 is catalyzing massive change in Saudi Arabia, reshaping everything from startup regulation to capital deployment. With the Saudi Venture Capital Company now the largest LP in Endeavor Catalyst, the region is doubling down on innovation.

M&A activity is on the rise, and local IPO reforms are giving founders more options. Miami founders looking toward expansion in the Middle East may find new opportunities in these rapidly evolving markets.

7. Europe is betting big on deep tech, and its technical founders

A new wave of technical CEOs is emerging in Europe, often coming from PhDs and engineering backgrounds. These founders are building ambitious companies in deep tech, space, AI, and green infrastructure—many backed by government funding and strong academic roots.

While the talent and capital dynamics differ from Miami, the core insight holds: technical founders, when paired with execution skills, are building the next generation of globally competitive startups.

8. Nigeria has a blueprint for building a global from local

Two of Nigeria’s five unicorns were founded by Endeavor Entrepreneurs. What they share is a formula: solve local pain points that echo globally, build strong compliance and trust, and scale with international capital.

In fast-moving, high-growth markets like Nigeria, local relevance paired with global vision is proving to be a powerful mix. This mindset also drives many of our most successful Endeavor Miami companies.

Want the full global picture? Read the original article from Endeavor Catalyst:8 Global Venture Capital Trends to Watch in 2026